INTUIT

How to start a business

5-step guide to kickstart your entrepreneurship journey

Small businesses are the heartbeats of communities across the country. They make where we live, work, and play truly thrive.

It’s no wonder there are now almost 32 million small businesses in the U.S.

For those who dare to dream, there’s no time like the present to create something new and leave a legacy. The hard part is transforming that dream into a living, breathing, long-lasting business.

Don’t know where to begin? Consider this your 5-step guide for how to kickstart your entrepreneurship journey.

Business basics: Getting started

As an aspiring entrepreneur, there’s some crucial prep work you have to do before launching your small business.

This starts with drafting a mission statement to define your vision. In a few clear and concise paragraphs, your mission statement should:

Outline your business idea

Define your company’s purpose and its goals

Identify the high-level strategies you’ll use to accomplish them

Include a motivational message that inspires you to work toward your dream.

Your mission statement will serve as your “why” and will create something tangible you can revisit as you navigate the journey of entrepreneurship.

LEARN MORE

72% of people who want to start a business within the next 12 months feel optimistic about their prospects.1

Refine your idea

Once you have a mission statement, research your market to fine-tune your idea.

Find out who the key players and industry leaders are and identify your competitors, both in the brick- and-mortar space and online. Next, your company’s value proposition, or how you’ll set yourself apart. For example, if you plan to open a local coffee shop, you’ll need to know how many other coffee houses or cafes are within a 5-10 mile radius, what they do that makes them successful, and how you’ll make your business stand out from them. Maybe you’ll offer one-of-kind menu items, your own handcrafted coffee, custom blends, or customer conveniences like a lending library, tables with multiple charging ports, or booths where customers can do video conferencing calls. Think about what makes your business truly unique and how you’ll harness this to set yourself up for success.

7 Current business owners say researching the competition is the second most important thing you can do before you start a business. But 19% of prospective business owners say they don’t intend to do it.1

Now is also a good time to start thinking about your business name. It can be something with deeper meaning to you, a play on a common industry term or something catchy customers will remember. To get started, use a thesaurus, online name generator, or set aside time to brainstorm.

Whatever names you land on, make sure they aren’t too difficult to spell or pronounce and get feedback from friends, family, and mentors before finalizing your decision. Also, do a trademark search on the U.S. Patent and Trademark Office’s website, USPTO.gov, and a search on your Secretary of State’s website to make sure the name isn’t already taken.

Your business name is important because you’ll need it later if you decide to incorporate your business or register it with the state or your local municipality.

76% of prospective business owners say they’ll choose their own business name, rather than pay an outside expert for help with this.1

Define your

target customers

Figure out the total addressable market (TAM) of your potential customer base. Determining your TAM will help you understand just how big the potential market for your product or service really is, especially if you plan to start an online business.

A simple way to figure out your TAM is to search online for industry data and market research reports, look at publicly available customer surveys and trends data from organizations like Pew Research Center, or local Census data if you’re launching a brick-and-mortar business.

From here, drill down to find your target customers. Your target customers are a group of people with common characteristics and behaviors that you’ll target in your marketing strategy. You can find your target customers by:

Assembling demographic data on age, gender, education, income, and location for the people you think will be interested in your products or services

Creating customer personas, which are detailed character sketches of a specific target buyer for your product or service

Reviewing your competitors’ websites, social media, and marketing communications to see who they’re targeting

Talking to friends or family members who represent your target customers

Discovering and doing a deep dive into online or social media communities where your target customers gather

Conducting a quick survey with a select group of your social media friends and followers who represent your target customer

Craft your business plan

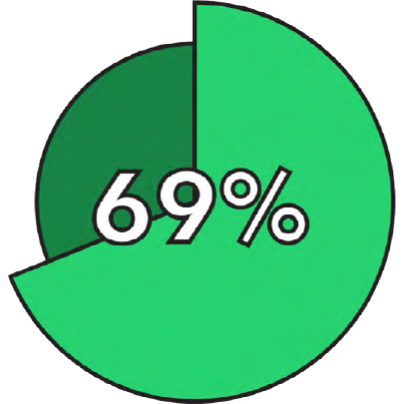

Nearly 70% of people who already own a small business recommend writing a business plan before moving forward with your business idea. But 13% of prospective business owners say writing a business plan isn’t a priority for them.

While writing a business plan can be daunting, it’ll provide a comprehensive roadmap for where you want your business to go—and how you plan to get there. The good news is that if you’ve followed steps 1-3, you’ve already done a lot of the legwork to get started.

A solid business plan is usually 10-20 pages and includes 10 essential elements:

Executive summary: An executive summary is typically a one-page, high-level overview of what’s in your business plan. Think of this as an extended, more narrative version of a table of contents.

Company description: Includes your mission statement, work or business history, key objectives, and value proposition.

Market research: Details your potential market size and target customer(s).

Competitive analysis: Overview of the research you’ve done on competitors, their strengths, weaknesses, and unique selling proposition.

Product or service description: Distills the benefits, production process, and lifecycle of your products or services, and why what your business offers is better than competitors.

Marketing and sales strategy: Covers your plan to attract new customers and grow your business, including what advertising and promotional channels and customer retention tactics (e.g. loyalty or referral programs) you’ll use to execute this strategy.

Business financials: Includes your business’s proposed operating budget and financial plan, which you’ll need to get a bank loan or money from investors.

Organizational and management structure: Describes your team, their roles and experience, and how their unique skills will add value to your business. This section also should include the future roles you may need to hire for to propel your business’s growth.

Funding needs: Details how much money you’ll need to fund your business. This should be a realistic range that factors in both best and worst-case scenarios. This section is crucial if you’re a startup raising money from investors.

Appendix: Assemble a well-organized appendix for anything and everything investors will need to conduct due diligence and you or your team will need easy access to moving forward. Your appendix should include legal documents, business registries and professional licenses, and information regarding your legal structure and business type, patents, and intellectual properties. Also, don’t forget to include a table of contents to make everything easily searchable.

69% of small business owners recommend writing a business plan before you start a business.1

Assess your finances

Launching a business comes at a cost. You’ll need capital to get started, but you’ll have to understand your startup expenses first.

Start by mapping out the projected costs for your first year in business. This should include things like:

Fixed costs, including rent, payroll, taxes, and business insurance payments

Variable costs such as utilities, marketing, and office supplies

Business fees for permits, licenses, registration and incorporation fees at the local, state, and federal levels, and the cost for web and logo design, brochures, and business cards

Fee to make improvements to leased space, if your business is a brick-and-mortar

The cost of legal and professional services, such as accounting, bookkeeping, and lawyer fees

The cost of software and equipment, such as accounting tools, inventory tracking and payroll management software, laptops, smartphones, office furniture, kitchen equipment, and more

Loan payments if you’ve borrowed money from a financial institution, family member, or business partner

As you plan for these costs, keep track of everything and potential IRS deductions you might qualify for, which can offset some of your startup and ongoing expenses.

Many private foundations, cities, and states also offer startup funding programs to attract new businesses to their area. Do your research to find out what funding is available in your community, what you’re eligible for, and how to apply.

Ways to structure your business

Sole proprietor or sole owner

This is a popular option for anyone who doesn’t have a lot of liabilities (e.g., no employees or significant investments) when they first start. As your business grows, you may want to change legal structures. Being a sole proprietor could be an excellent option if you have a small side- hustle or day job.

Business partnership

If you’re going into business with a partner, then you’ll need to register as a business partnership or limited partnership. Expect to work with a lawyer and a tax professional to lay out your partnership type, terms, and tax implications.

Incorporated business

Liability protection and tax breaks are some of the advantages of incorporating your business. Because of upfront costs, many sole proprietors wait until they’ve earned enough revenue and are at the right stage to incorporate.

Limited liability company (LLC)

An LLC is a U.S.-specific form of a private limited company. This structure protects business owners, managers, and the LLC itself against certain types of personal liability. If you plan to operate from a brick- and-mortar location, personal liability is an important consideration. If someone gets injured on your property, you may not be held personally liable for the damages if you have an LLC.

Whether your business is an LLC, corporation, or partnership, keep in mind you’ll likely need to register your business with any state where you conduct business. You should reach out to a lawyer to determine the best business structure for your needs.

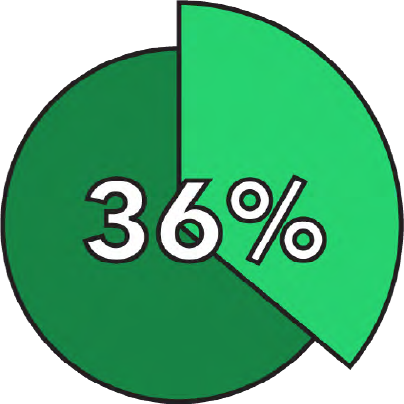

36% of people who want to start a business admit that getting funding is one of their top three financial priorities.1

Conclusion

Opening a small business and becoming an entrepreneur takes the right mix of courage, luck, and hard work.

The journey is never a straightforward line, but you can make it a little easier. By being as prepared and as knowledgeable as possible about what it’ll take to launch your business, you can transform it from the kernel of an idea into a thriving, successful company customers truly love.

Want a Printable Version?

Download the PDF for more workbook pages.

Sources

1. Source: 2020 QB commissioned survey of 1,600 current and prospective business owners